.png)

As a global hub for the gem and jewelry trade, Thailand has implemented significant tax measures to enhance the competitiveness of its local entrepreneurs. The Gem, Jewelry and Precious Metal Confederation of Thailand (GJPCT) and the Thai Gem and Jewelry Traders Association (TGJTA) have been instrumental in successfully lobbying the government for these policies. Membership in these associations not only builds business networks but also unlocks substantial tax advantages every industry player needs to know.

Exclusive Tax Benefits: The Thai Entrepreneur's Advantage

Driven by the relentless efforts of the GJPCT and TGJTA, led by Mr. Somchai Pornjindarak, these government-backed tax measures are designed to drastically reduce costs and boost competitiveness:

1. 0% Import Duty Under a Ministry of Finance notification (No. 2, B.E. 2560), all goods under HS Code Chapter 71 are now exempt from import duties, reduced to 0% from a previous high of 20%. This comprehensive exemption covers:

Rough and polished diamonds and gemstones

Pearls

Finished jewelry and their components (e.g., chains in rolls)

This measure provides a massive cost reduction, enabling Thai businesses to compete more effectively on price in the global market.

2. VAT Exemption for Registered Businesses VAT-registered entrepreneurs gain further advantages:

0% VAT on Imported/Traded Gemstones (Form P.P. 01.5): A VAT exemption applies to the import and sale of unset diamonds, gemstones, pearls, etc., intended for the production of jewelry for export. This also applies to trades between registered members, significantly improving supply chain liquidity. (Note: This permit requires annual renewal).

0% VAT on Precious Metals (Form P.P. 01.3): This exemption covers the import and sale of gold (96.5% purity or higher), silver, platinum, and palladium in their raw forms. For finished gold jewelry, VAT is only levied on the craftsmanship fee ("ค่ากำเหน็จ"), not the value of the gold itself.

3. Tax Benefits for Individuals To support small-scale traders, the government has introduced tax relief for individuals:

VAT Exemption: For the importation of "rough or uncut gemstones" for sale (per Royal Decree No. 617).

Personal Income Tax Exemption: For income derived from the sale of such rough gemstones (per Royal Decree No. 618).

The Commercial Gem & Jewelry Import Process

Register as an Importer: Sign up with the Thai Customs Department via its electronic, paperless system (e-Customs).

Prepare Documentation: Compile all necessary documents, including the Import Declaration, Commercial Invoice, Bill of Lading (B/L) or Air Waybill (AWB), and any special permits (e.g., a Kimberley Process Certificate for rough diamonds).

Submit & Clear Customs: Submit all data through the e-Customs system. Pay any applicable duties or taxes (though most are exempt under these schemes). Shipments are assigned to either the "Green Line" (clearance without inspection) or "Red Line" (requires physical inspection).

Release of Goods: Once cleared, the goods can be released from customs custody.

Penalties for Non-Compliance: The High Cost of Evasion

These significant benefits come with the strict responsibility of legal compliance. Customs evasion is a serious criminal offense in Thailand with severe penalties.

| Offense Type | Maximum Imprisonment | Fine | Confiscation of Goods |

| Smuggling (Non-declaration) | 10 years | 4x the value of goods + duty | Goods will be confiscated |

| Duty Evasion (False declaration) | 10 years | 0.5x - 4x the evaded duty | Court may order confiscation |

| Evading Restrictions (No permit) | 10 years | Up to 500,000 THB | Goods will be confiscated |

The Thai government provides unparalleled tax incentives to support its gem and jewelry industry. Membership in key trade associations like the TGJTA is crucial for accessing these benefits. However, transparent and lawful operation is non-negotiable for sustainable success in the global market.

In an era where people seek unique ways to memorialize their departed loved ones, "Cremation Diamonds" have emerged as a compelling option. Various companies claim they can extract carbon from cremation ashes or hair to synthesize beautiful, genuine diamo

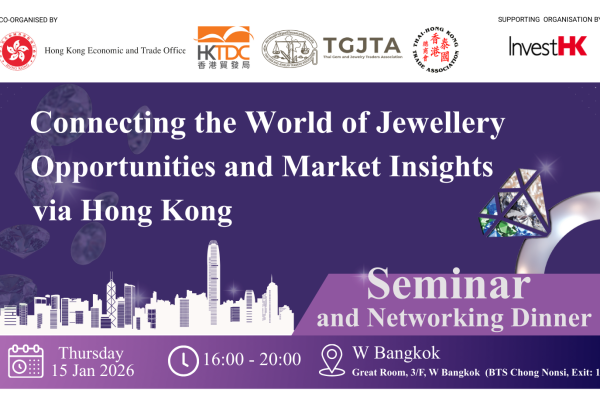

TGJTA in collaboration with HKETO, HKTDC, and InvestHK is pleased to invite members and industry professionals to attend a special seminar and networking dinner.

A "Convergence of Value"—a phenomenon where jewelry and gemstones are no longer mere accessories, but have evolved into one of the world's most robust Alternative Asset Classes.